Unified declaration on insurance premiums. The procedure for filling out the calculation of insurance premiums

Since all insurance premiums, except for professional fees. diseases, in 2019 will come under the jurisdiction of the Federal Tax Service; they will need to be paid directly to the tax authorities. But entrepreneurs will still have to submit some types of reporting to the funds. Since payments will be made to the tax authorities, and the interdepartmental exchange of information is not particularly developed, tax authorities, to simplify their own work, have provided a new type of reporting document, called in 2019 the Unified Calculation of Insurance Contributions.

It is worth noting that the prefix “single” appeared from accountants, since this type of reporting combined all types of contributions for the purpose of insurance.

You can download the form for a “single” calculation of insurance premiums to fill out in PDF format at. This form according to the KND 1151111 form contains absolutely all sections and possible applications.

All persons engaged in business, as well as organizations that pay insurance premiums, are required to submit a reporting document.

It is worth remembering that entrepreneurs who do not have employees pay insurance premiums only for themselves. Benefits for them begin to apply when payments reach a certain amount. After which contributions are either stopped or paid at a reduced rate.

If an entrepreneur has employees, then he is obliged to pay insurance premiums for them. An important point is the fact that different BCCs will be used to pay the contribution for yourself and for your employee.

Organizations also act as insurers for their employees. They pay their dues based on their salary and other benefits that employee receives from the workplace. It should be noted that neither an entrepreneur nor an organization has the right to deduct payments for employees from the wages of their workers.

If the staff of a business entity exceeds the average statistical number of people, then reporting is required to be submitted in electronic format.

How to fill out a document

The 2019 Unified Calculation Form for Insurance Premiums offers three sections to fill out, as well as a title page.

- Title page standard It contains general information about the organization or individual entrepreneur.

- In the first section all settlement processes will be carried out for the contributions made by the policyholder. This section is the most voluminous and will require the person filling out maximum knowledge of the principles of calculating amounts for insurance premiums. It is devoted to “Summary data on the obligations of the payer of insurance premiums.”

- Second section is provided for contribution payers by a person who is the head of a farm or peasant-type enterprise. It will not always be filled by everyone.

- In the third section contains information regarding insured persons and payments to them. This is information for each individual individual for whom insurance premiums will be paid.

An entrepreneur must take into account that if the average number of all employees to whom payments were made during this reporting period exceeds the number of people, then the reporting must be submitted in electronic format. If this number is less, then in paper form. By the way, the reporting document can be brought to the Federal Tax Service at the place of registration yourself or sent by mail.

Sample and example of filling out the Calculation of insurance premiums (KND 1151111)

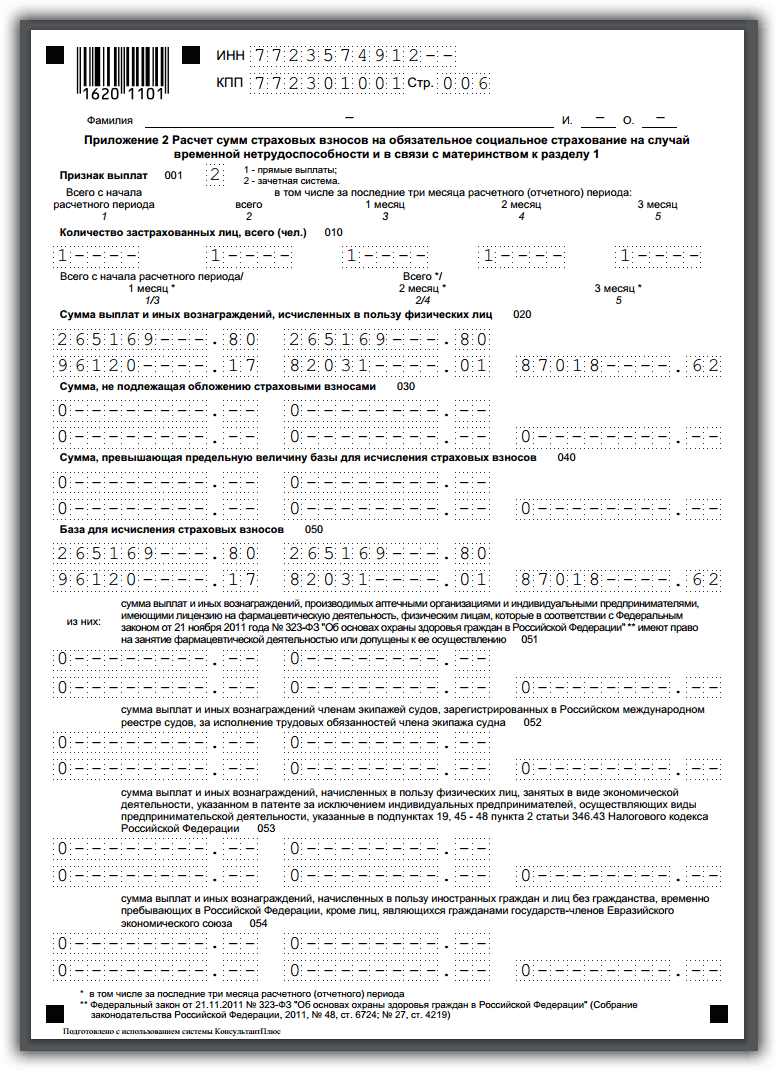

You can download an example of filling out in PDF format or see it in the images below.

Title page

Section 1

In our case, there is no section 2, since the organization is not a farm.

Section 3

General requirements for filling out a single calculation for insurance premiums

Submit reports for the first annual quarter, that is, submit the Unified Calculation to the tax authorities for the first time required before 04/30/2019.

The form can be filled out by the entrepreneur himself or a responsible person appointed by him. When filling out, you must comply with the following requirements:

- To fill out the form, you must use blue, purple or black ink.

- To fill out the text field, you must use printed capital letters. The applicant also has the right to create and complete the form in a computer format.

- Page numbering is continuous. The first page is considered the title page and is numbered as 001. The fifth, for example, as 005, and the thirteenth - 013.

- The fields are filled in from left to right.

- Monetary units are displayed using rubles and kopecks. If the amount indicator is not entered, then a zero is entered, if any other indicator is a dash.

- Corrections with a proofreader, printing on both sides of the sheet, or binding pages as a result of which they may become damaged are not permitted. In this, the form of the Unified Calculation of Insurance Premiums 2019 is similar to other types of reporting documentation.

Watch also the video about the new reporting form:

Violations and liability

Failure to submit a report on time will result in a fine of 200 rubles for each form not submitted. If you fail to submit your annual report on time, the fine may amount to as much as 5% of the amount of required contributions. There are clarifying provisions that this fine cannot exceed 30% of income, but should not be less than 1 thousand rubles.

Tax authorities may recognize the report as not submitted if the calculated amount of contributions does not correspond to the amount that is formed when combining the insurance amounts for each individual person. In this case, they will notify the entrepreneur that the report will not be accepted for consideration, and he, in turn, undertakes to submit the correct form within five days.

If during the course of your activities an error is found in a report that has already been submitted, you must submit a clarifying document to the tax authorities as soon as possible.

What is the procedure for filling out section 3 of the calculation of insurance premiums in 2017, submitted to the Federal Tax Service? How many sections 3 should I fill out? Do I need to fill out 3 for each employee? You will find answers to these and other questions, as well as an example of filling out Section 3, in this consultation.

What is section 3 for and who fills it out?

In 2017, a new form of calculation for insurance premiums is being used. The form was approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551. Cm. " ".

This reporting form includes section 3 “Personalized information about insured persons.” In 2017, section 3 as part of the calculation of contributions must be filled out by all organizations and individual entrepreneurs that have paid income (payments and rewards) to individuals since January 1, 2017. That is, section 3 is a mandatory section.

Who to include in section 3

Section 3 provides for the inclusion of personalized information for each individual in relation to whom in the last three months of the reporting (calculation) period the organization or individual entrepreneur was the insured. It does not matter whether during this period there were payments and rewards in favor of such individuals. That is, if, for example, in January, February and March 2017, an employee under an employment contract was on leave without pay, then this should also be included in section 3 of the calculation for the 1st quarter of 2017. Since during the designated period of time he was in an employment relationship with the organization and was recognized as an insured person.

Of course, it is necessary to formulate section 3 for persons in whose favor in the last three months of the reporting period there were payments and remunerations under employment or civil contracts (clause 22.1 of the Procedure for filling out calculations for insurance premiums, approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. MMV -7-11/551).

Read also How to reimburse personal income tax for purchasing an apartment

Let us assume that during the reporting period a civil contract (for example, a contract) was concluded with an individual, but the person did not receive any payments under this contract, since the services (work) have not yet been provided (performed). In this case, is it necessary to include it in section 3 of the calculation of insurance premiums? In our opinion, yes, it is necessary. The fact is that those employed under civil contracts are also recognized as insured persons by virtue of paragraph 2 of clause 1 of Article 7 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance”.

We also believe that section 3 should be formed for the general director, the only founder with whom the employment contract has been concluded. After all, such persons are also named in paragraph 2 of paragraph 1 of Article 7 of the Federal Law of December 15, 2001 No. 167-FZ “On Compulsory Pension Insurance”. Therefore, they should fall under section 3. Even if they did not receive any payments from their own organization in the last three months of the reporting period.

How to fill out section 3: detailed analysis

Initial part

If you are filling out personalized information for a person for the first time, then enter “0–” on line 010. If you are submitting an updated calculation for the corresponding billing (reporting) period, then show the adjustment number (for example, “1–,” “2–,” etc.).

In field 020, reflect the code of the billing (reporting) period, for example:

- code 21 – for the first quarter;

- code 31 – for half a year;

- code 33 – for nine months;

- code 34 – per year.

In field 030, indicate the year for the billing (reporting) period of which personalized information is provided.

Check

The value of field 020 of section 3 must correspond to the indicator of the field “Calculation (reporting period (code)”) of the title page of the calculation, and field 030 of section 3 - the value of the field “Calendar year” of the title page.

In field 040, reflect the serial number of the information. And in field 050 – the date of submission of information. As a result, the initial part of section 3 should look like this:

Read also Payments to the general director - the sole founder - are subject to insurance premiums

Subsection 3.1

In subsection 3.1 of the calculation, indicate the personal data of the individual for whom section 3 is being filled out. We will explain what personal data to indicate and provide a sample:

| Line | Filling |

|---|---|

| 060 | TIN (if available) |

| 070 | SNILS |

| 080, 090 and 100 | FULL NAME. |

| 110 | Date of Birth |

| 120 | Code of the country of which the individual is a citizen from the Classifier approved on December 14, 2001 No. 529-st, OK (MK (ISO 3166) 004-97) 025-2001 |

| 130 | digital gender code: “1” – male, “2” – female |

| 140 | Identity document type code |

| 150 | Details of the identity document (series and document number) |

| 160, 170 and 180 | Sign of an insured person in the system of compulsory pension, medical and social insurance: “1” – is an insured person, “2” – is not an insured person |

Subsection 3.2

Subsection 3.2 contains information about the amounts:

- payments to employees;

- accrued insurance contributions for compulsory pension insurance.

However, if you are filling out section 3 for a person who has not received any payments in the last 3 months of the reporting (settlement) period, then this subsection does not need to be filled out. This is stated in paragraph 22.2 of the Procedure for filling out calculations for insurance premiums, approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551. If the fact of payments took place, then fill out the following fields:

| Count | Filling |

|---|---|

| 190 | The serial number of the month in the calendar year (“01”, “02”, “03”, “04”, “05”, etc.) for the first, second and third month of the last three months of the billing (reporting) period, respectively. |

| 200 | Category code of the insured person (according to Appendix 8 to the Procedure for filling out the calculation). Enter the code in capital letters of the Russian alphabet. For example - HP. |

| 210 | The total amount of payments in favor of an individual for the first, second and third months of the last three months of the billing (reporting) period, respectively. |

| 220 | The basis for calculating pension contributions, not exceeding the maximum value. In 2017, this value was 876,000 rubles. |

| 230 | The amount of payments under civil contracts (allocated from the database). |

| 240 | Amount of pension insurance contributions. |

| 250 | The total amount of payments in favor of the employee, not exceeding the maximum base amount for all three months of the reporting (billing) period. |

1. TIN and checkpoint.

The corresponding codes are indicated. The field provided for filling out the TIN code contains 12 acquaintances, so legal entities need to put dashes in the last two acquaintances.

Individual entrepreneurs do not fill out the checkpoint field. Organizations indicate the checkpoint at the place of registration of the legal entity itself or its division.

2. Correction number.

If the form is submitted for the reporting period for the first time, the code “0-” is filled in. An updated report is submitted if the data submitted to the inspection earlier has changed. In such a situation, the serial number of the updated calculation is indicated: “1-”, “2-”, etc.

3. Billing period. The billing period code is filled in:

| Code | Code upon liquidation (reorganization) of a legal entity | Code when deregistering an individual entrepreneur (head of a peasant farm) | Reporting period |

| 21 | 51 | 83 | 1st quarter |

| 31 | 52 | 84 | half year |

| 33 | 53 | 85 | 9 months |

| 34 | 90 | 86 | year |

4. Calendar year. The year during which or for which the information is provided is filled in.

5. Tax authority code.

The four-digit code of the Federal Tax Service to which the calculation is submitted is entered. The first two digits of this code are the region number, the last two digits are the inspection number. You can find out the code on the tax website using this link.

6. Code at the place of registration. The code for the location of the policyholder is indicated:

| Code | Name |

| At the place of residence: | |

| 112 | individuals who are not individual entrepreneurs |

| 120 | IP |

| 121 | lawyer |

| 122 | notary |

| 124 | heads of peasant farms |

| At the place of registration: | |

| 214 | Russian organization |

| 217 | successor of the Russian organization |

| 222 | OP of a Russian organization |

| 238 | legal entity – (head) peasant farm |

| 335 | OP of a foreign organization in the Russian Federation |

| 350 | international organization in the Russian Federation |

7. Name of the legal entity or its sole proprietor (full name, individual entrepreneur; individual who is not an individual entrepreneur)

Fill in the full name of the legal entity, full name. individual entrepreneur (a person not recognized as an entrepreneur).

8. OKVED code 2. You must indicate the code for the type of economic activity of the policyholder from the new directory of OKVED codes 2.

9. Form (code) of reorganization (liquidation) and TIN/KPP of the reorganized legal entity.

To be filled out only upon liquidation (reorganization) of the company. In such cases, indicate the code corresponding to the situation that has arisen from Appendix No. 2 to the Procedure:

| Code | Name |

| 1 | Conversion |

| 2 | Merger |

| 3 | Separation |

| 4 | Selection |

| 5 | Accession |

| 6 | Division with simultaneous accession |

| 7 | Selection with simultaneous appendage |

| 0 | Liquidation |

New form "Calculation of insurance premiums" officially approved by the document Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11/551@.

More information about using the form "Calculation of insurance premiums":

- Calculation of insurance premiums: we submit without errors

Which directly relate to insurance premiums. At the beginning, let us remind you that the calculation of insurance premiums is due no later than... /3209@. The most common errors in the calculation of insurance premiums The organization incorrectly indicates personal data... after the organization submits the calculation of insurance premiums to the tax authority, the updated calculation is not submitted. Such... “Personalized information about the insured persons” for the calculation of insurance premiums, as stated in the Letter of the Federal Tax Service of the Russian Federation...

- Desk audit of insurance premium calculations

Documents other than the submitted calculation of insurance premiums? As a general rule, the object of the audit is the calculation of insurance premiums, the form and... the requirement to provide explanations for identified errors in the calculation of insurance premiums, for contradictions between information... for the tax authority to recognize the calculation of insurance premiums as unsubmitted. So, the calculation (adjusted calculation) is considered not presented if...

- What to consider when submitting a calculation of insurance premiums for 9 months of 2017?

Within the framework of this material. The procedure for submitting calculations for insurance premiums Let us recall the basic rules for presenting the indicated... there are no specific features for submitting calculations for insurance premiums (see Letter from the Ministry of Finance of Russia...). Therefore, such organizations submit calculations of insurance premiums to the inspectorate at their location. And... submit a “zero” calculation. Failure to submit a zero calculation for insurance premiums will result in a fine for the payer of contributions (according to...

- Calculation of insurance premiums: questions and answers

Payers of insurance premiums reported on a new calculation of insurance premiums (hereinafter referred to as the calculation). Accordingly, questions arose about filling out... insurance premium payers reported on a new calculation of insurance premiums (hereinafter referred to as the calculation). Accordingly, questions arose about filling out... in accordance with the format for submitting calculations for insurance premiums in electronic form, also... the control ratios of the indicators of the calculation form for insurance premiums are sent for work by territorial...

- Updated calculation of insurance premiums for injuries

To the territorial body of the insurer at the place of their registration, calculation of insurance premiums (according to form 4-FSS... to the territorial body of the insurer at the place of their registration, calculation of insurance premiums (according to form 4-FSS... below. Composition of the reporting form Calculation of insurance premiums for injuries for nine months... the main nuances of filling out the mandatory tables for calculating insurance premiums for injuries. Table number... for a pilot project, in the submitted calculation for insurance premiums this table is not filled out and...

- Correcting errors in the calculation of insurance premiums

Accountants, it has become impossible to submit the “Calculation of Insurance Premiums” due to errors in the database... For the deadline for submitting clarifying information on the Calculation of Insurance Premiums, the general procedure for submitting information applies... 5% of the total amount of debt for the Calculation of Insurance Premiums. A fine is charged for each... . So, if an error in the calculation of insurance premiums did not cause a change in the calculated ones... the tax is obligatory. Such updated information on the Calculation of insurance premiums must include completed...

- The absence of an employee’s TIN is not a reason for refusing to accept the calculation of insurance premiums

In the new Calculation of Insurance Premiums, introduced by the tax authorities by order of the Federal Tax Service of Russia... the policyholder has questions. In the new Calculation of insurance premiums, introduced by the tax authorities by order of the Federal Tax Service of Russia... pension contributions broken down by insured persons specified in the Calculation. So, the value by line... year? When creating Section 3 of the calculation of insurance premiums, you need to pay attention to these... nuances: When filling out section 3 of the calculation of insurance premiums: the total values should be indicated without...

- Let's get acquainted with the new form: calculation of insurance premiums

All insurance premium payers? How is the updated calculation of insurance premiums presented? What are the features of filling out a calculation of insurance premiums, the form of which...? What sections of the calculation are filled out by all insurance premium payers? How is the updated calculation of insurance premiums presented? By order of the Federal Tax Service... the form for calculating insurance premiums, the procedure for filling it out (hereinafter referred to as the Procedure), as well as the format for submitting calculations for insurance premiums...

- New form for calculating insurance premiums: description, deadlines for submission and procedure for filling out

A new form for calculating insurance premiums and the procedure for filling out this calculation (hereinafter referred to as the Procedure) have been approved.... Meet the new form for calculating insurance premiums. The said order will enter into... deadlines for reporting. The new calculation of insurance premiums is a synthesis immediately... of connections with motherhood. Pages for calculating insurance premiums Required submission Submitted... 2017) payers of insurance premiums will be required to submit calculations for insurance premiums no later than 30 ...

- Is it necessary to reflect in reporting on insurance premiums payments that are made to employees in connection with sending them on a business trip?

Lines and columns for calculating insurance premiums. Justification for the position: ... insurance premiums - organizations submit to the tax authority, in particular, at the location of the organization, a calculation of insurance premiums... (hereinafter - the Calculation) is not... approved The procedure for filling out the calculation of insurance premiums (hereinafter - the Calculation, Order). Item... Calculation of insurance premiums from January 1, 2017; - Encyclopedia of solutions. Insurance premium reporting...

- Deadline for submitting the report on insurance premiums for 2018

Introduce. The deadline for submitting a report on social security contributions depends on the method... of submission. The deadline for submitting a report on insurance premiums to social insurance depends on the method... of the Tax Code of the Russian Federation, the calculation of insurance premiums is submitted to the Federal Tax Service at the location of the company (at the location... those who have employees are required to submit a zero calculation for insurance premiums (letter from the Federal Tax Service of Russia dated.. .Article 431 of the Tax Code of the Russian Federation, the calculation of insurance premiums is submitted quarterly no later than 30... 2018, it is necessary to submit: the calculation of insurance premiums to the Federal Tax Service on time...

- Reporting on insurance premiums for the year

A new reporting form has also been introduced - Calculation of insurance premiums, approved by order of the Federal Tax Service dated 10 ... and a new reporting form - Calculation of insurance premiums, approved by order of the Federal Tax Service dated 10 .... Questions about the Calculation of Insurance Premiums In the new Calculation, accountants need to indicate information... the inspectorate warned that the Calculation of Insurance Premiums should not contain negative values... the form of calculation for insurance premiums, the procedure for filling it out, as well as the format for presenting the calculation of insurance premiums contributions to...

- Insurance premium report and foreign workers

To section 1 of the regulated report "Calculation of insurance premiums" - this appendix is filled out by organizations that... to section 1 of the regulated report "Calculation of insurance premiums" - this appendix is filled out by organizations that... and taxes, as well as filling out the calculation of insurance premiums for foreign citizens in “1C: Salary... reporting of calculation of insurance premiums Go to the section “Reporting, certificates” - “Reporting”. We create a new report “Calculation of insurance premiums...

- Autumn victorious decisions on insurance premiums

Disputes with Funds regarding the calculation of insurance premiums in common situations. Insurance premiums for “refused... submit to the tax authorities an updated calculation of insurance premiums, including the not accepted amount in... only the “bare” amount of contributions due to the fact that the paid insurance premiums are not collected... that the requirement for payment arrears on insurance premiums, penalties and fines are charged with... there is no information: on the amount of arrears on insurance premiums on which penalties are charged; period...

- Features of filling out an application for cash expenses for insurance premiums

That in order to pay monetary obligations for insurance premiums, government institutions that are recipients of funds ... payment may conduct a joint reconciliation of calculations for insurance premiums. Based on the application submitted by the institution... in 2017, after offset of the overpayment of insurance premiums: for compulsory health insurance, VNiM, compulsory medical insurance it is necessary... the institution can conduct a joint reconciliation of calculations for insurance premiums. Based on the results of such reconciliation, an act is drawn up...

In this article we will consider all aspects of the preparation and submission of such regulated reporting as Calculation of insurance premiums. Information will also be provided on the deadlines for submission, the procedure for filling out and penalties for the absence of this reporting.

Replacing ERSV

Previously, the report on insurance premiums was under the supervision of the Pension Fund of the Russian Federation, and insurance premiums for compulsory pension, medical and social insurance were also paid there. But, starting in 2017, all insurance premiums came under the jurisdiction of the Federal Tax Service. ERSV was replaced by Calculation of Insurance Premiums.

Who rents

All legal entities, as well as individual entrepreneurs with employees, are required to submit a declaration. To accurately determine the need to submit reports, you can refer to the table.

Where to submit the report

This report is submitted to the tax office at the place of registration of the individual entrepreneur or the place of registration of the LLC. It happens that the report must be submitted not to the tax office at the legal address of the company, but to the tax office at the place of registration of the separate division. This may occur if the parent organization gives the Separate Unit the right to independently calculate and assess insurance premiums. This rule is approved by order of the manager, about which the tax inspectorate is informed in any form.

Deadlines for submitting a unified calculation of insurance premiums in 2018

The deadline for submitting the DAM is set by the Federal Tax Service as the 30th day of the first month following the end of the quarter. It should be noted that the report is submitted quarterly, that is, four times a year. The deadlines for submitting the report in 2018 are as follows:

- For 2017, a report must be submitted by January 30, 2018;

- For the first quarter of 2018 - until April 30;

- For the second quarter of 2018 - until July 30;

- For the third quarter in 2018 - until October 30;

- For the fourth quarter of 2018, the report is due by January 30, 2019.

Important! For late submission of a report, the tax code provides for a fine of at least 1,000 rubles.

Calculation form

The declaration itself is submitted in the form established by the Order of the Federal Tax Service of the Russian Federation dated October 10, 2016 with the number ММВ7-11-551. This form is designated KND 115111 and consists of three sections:

- Summary information on the amounts of calculated insurance premiums;

- Summary information on the amounts of calculated insurance premiums for heads of peasant farms;

- Personalized data about the insured.

The declaration form itself can be downloaded here:

Amounts of insurance premiums

The common tariff for all payers of insurance premiums is currently equal to 30% of the amount of accrued wages. But there is also a reduced amount of insurance premiums that some categories of taxpayers can pay. For example, organizations and individual entrepreneurs using a simplified taxation system and engaged in production activities and other activities equivalent to them have the right to pay a reduced amount of insurance premiums - 20%. This 20% goes to pension insurance contributions, and health and social insurance contributions are not paid at all (except for contributions from accidents and occupational diseases). To make it clear, let’s look at the contribution amounts in the table.

Example 1.

- April - 65,000 rubles;

- May - 68,000 rubles;

- June - 70,000 rubles.

Let us explain that to calculate premiums, Roses LLC applies the basic tariff, and for insurance premiums for injuries it has a tariff of 0.2%. The calculation is given in the table.

| Month of the year | Amount of contributions | |||

| Pension Fund 22.0% | FSS 2.9% | Compulsory medical insurance 5.1% | Social insurance from NS and PP 0.2% | |

| April | (65000*0,22) | (65000*0,029) | (65000*0,051) | (65000*0,002) |

| May | (68000*0,22) | (68000*0,029) | (68000*0,051) | (68000*0,002) |

| June | (70000*0,22) | (70000*0,029) | (70000*0,051) | (70000*0,002) |

| 2nd quarter | 44660 | 5887 | 10353 | 406 |

Example 2.

Let's calculate the amount of insurance premiums for LLC "Rosy", which is under a simplified taxation regime, has 5 employees and a total wage fund of:

- April - 65,000 rubles;

- May - 68,000 rubles;

- June - 70,000 rubles.

Let us explain that to calculate premiums, Roses LLC applies a reduced tariff, and for insurance premiums for injuries it has a tariff of 0.2%. The calculation is given in the table.

| Month of the year | Amount of contributions | |||

| Pension Fund 20.0% | FSS 0% | Compulsory medical insurance 0% | Social insurance from NS and PP 0.2% | |

| April | (65000*0,20) | 0 | 0 | (65000*0,002) |

| May | (68000*0,20) | 0 | 0 | (68000*0,002) |

| June | (70000*0,20) | 0 | 0 | (70000*0,002) |

| 2nd quarter | 40600 | 0 | 0 | 406 |